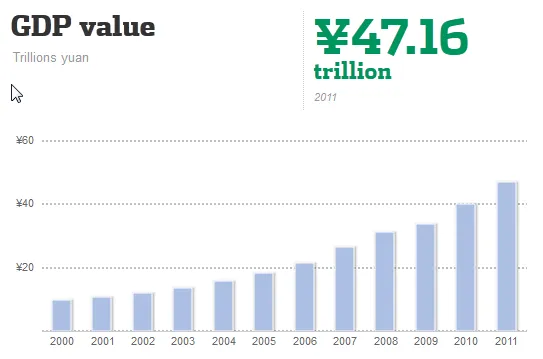

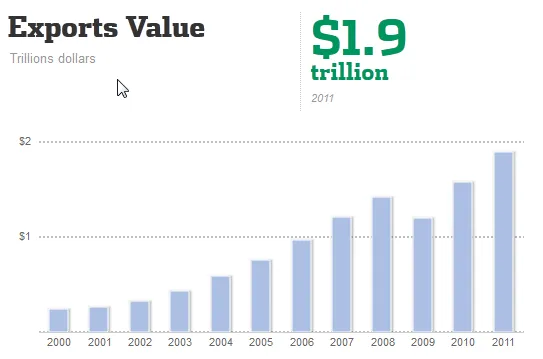

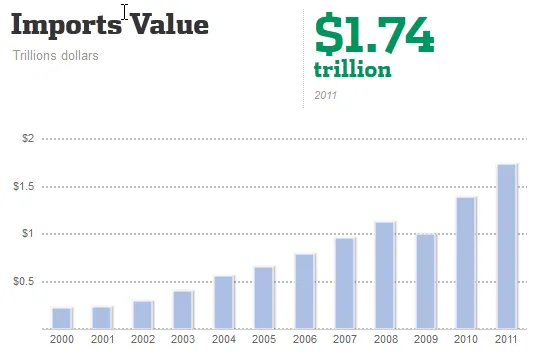

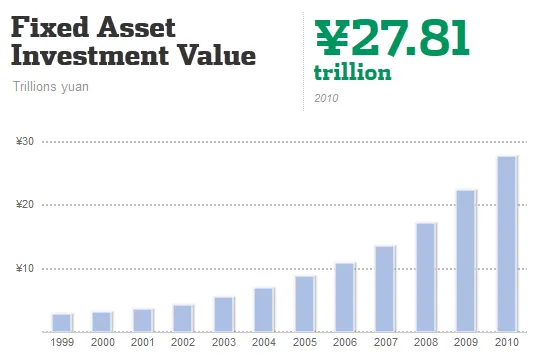

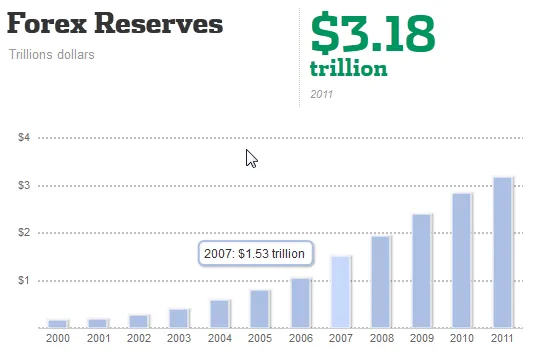

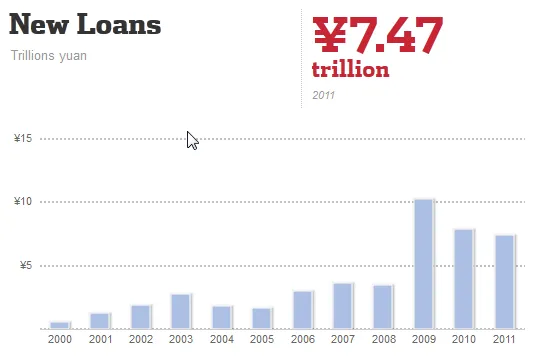

The Wall Street Journal China Econtracker site is a handy visualization of KPIs for the Chinese Economy. The aspects that stand out include that the GDP, Fixed Asset Investment and Foreign Exchange Reserves went fairly smoothly through 2008/09 and the GFC. The GFC effects stand out much more clearly in the Exports, Imports, CPI and especially the New Loans figures. The continuous push in New Loans and Fixed Asset Investment throughout all of this is amazing. None of the reality of this fixed asset investment is clear to me as we focus on day to day software development tasks in Perth, Australia. Will all of this investment in China make it even more of a powerhouse in the future or is it wasteful investment where the assets created aren’t fully utilized?

The interest in the Chinese economy is a natural pre-occupation for Western Australian businesses given the two speed economy that is present in both the state and the country. If a company is directly involved with work physically at a mine site or an oil/gas facility then business is good and rates are high. The less you’re involved directly with the mine sites and the benefit of the “boom” dwindles pretty quickly. There’s a saying I’ve heard a number of times in a variety of forms. Paraphrasing: In Australia, if you want to dig dirt out of the ground then you can get investment. However if you want to actually create something new or invent a new technology then its way way harder. It is frustrating seeing how much money and how many humungous mining and gas projects are going on in WA and Australia, but then contrasting that with how little investment is taking place outside of these realms in new technology and future oriented benefits. Are we going to squander the benefits of these times? As you can see, I have no answers, only questions.

PS: This is the first post where it will autopost to twitter, linkedin and an email group. We’ll see how it goes.